jersey city property tax abatement

When you sell the property adding this to your cost basis will reduce your capital gain. You can only claim 500 in Property tax.

Jersey City Abatement Policy Civic Parent

Jersey City Property Tax Abatement.

. 99 market rate residential buildings 46 commercial hotel office etc buildings and 14 affordable housing projects. Then in October the city threatened to terminate a 12-year tax. New Jersey authorized its municipalities to provide homeowners and property developers a 5-year tax abatement through the NJSA.

There is a 2 fee for all checks returned for insufficient funds. 5227H-60 et seq and shall include the entire area withi n. The 10000 is a service charge and is not property tax.

Abatement means a reduction. Left click on Records Search. Jersey City will terminate the tax abatement on four buildings within the Beacon residential complex after ownership defaulted on an obligation to.

For the past 4 years Ive been researching and writing about property taxes and revaluation among other topics on CivicParent. You should send your request for abatement to the address listed on your billing notice. The first came in January when the City Council voted to rescind a 15-year abatementon a 30 million residential project Downtown.

A listing of all parcels delinquencies and. A request for abatement must be in writing. This is currently taking a long time due to COVID Next someone from the tax assessors office will have to physically come to your house to take pictures etc.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Urban Enterprise Zones UEZs are created with the goal of stimulating economic activity in distressed areas. APPLICATION FOR REAL PROPERTY TAX ABATEMENT FOR RESIDENTIAL PROPERTY IN AN URBAN ENTERPRISE ZONE CHAPTER 207 PUBLIC LAWS 1989 as amended.

It cannot be granted in person by phone or through email. The seller should get the CO and file it for tax abatement. Bundle buying selling.

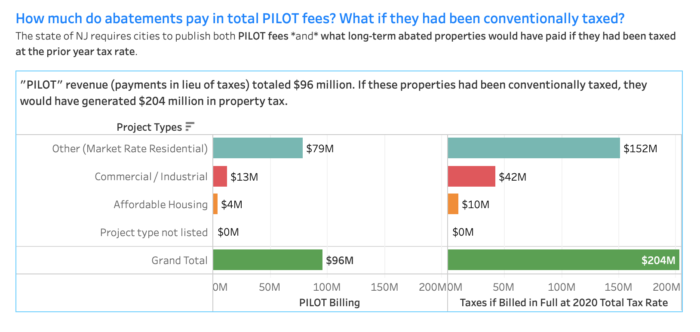

While schools receive a portion of regular property tax they do not receive any of the PILOT fees. In the past year Ive also written about tax appeals and I also served on a team of Jersey City Together volunteers in 2017 that helped over 30 residents save over 40000 in tax expense through successful appeals. Eduardo CToloza CTA City Assessor.

On June 5th I. The total assessed value of these abatements land and building is 126 billion. A request for abatement must be in writing.

Pursuant to the New Jersey Urban Enterprise Zones Act PL1983 c. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified billed. The signNow extension was developed to help busy people like you to reduce the burden of putting your signature on documents.

The latest iteration of Jersey Citys tax abatement policy retains the tiered structure while making minor tweaks to the policy. JERSEY CITY Mayor Steven M. Costs along with bidding instructions please visit.

Box 2025 Jersey City NJ 07303. There is a 5 fee to provide you with a duplicate tax bill. They are baked into the budget each year in significant amounts comprising 18 of total revenues in 2021.

These abatement types include specifically the Five-Year Exemption and Abatement Law. You can check that out here. Jersey City abatements have historically sent 95 of the PILOT fees to the city 5 to the county and 0 to the schools.

Say Thanks by clicking the thumb icon in a post. This law provides for five-year tax abatements to existing and newly constructed residential properties and non-residential structures converted to residential use in. Find a sellers agent.

Taxes are levied pursuant to chapter 4 of Title 54 of the. Office building store or any building shall display the street number pursuant to City Code 108-5. The 160 abatements are of different project types including.

The centerpiece of the revamped PILOT program was a tiered-system under which the terms of available tax abatements most notably the length of the abatement are largely determined by the location of the project. 2020-2021 and prior year delinquent taxes. By Mail - Check or money order to.

Line auction on June 22 2021 900 am. 5 Year Tax Abatement - Jersey City NJ Real Estate. Fulop announced today the city is moving forward with the termination of a tax abatement for 4 of the 6 buildings within The Beacon Community located at 20 Beacon Way after the developer Baldwin Asset Associates Urban Renewal Company Baldwin defaulted on its 2005 financial agreement with the City of.

This the most direct impact that abatements have on our schools but more is explained below. Abatements are a structural portion of Jersey Citys budget ie. The City of Union City announces the sale of.

While New Jersey law authorizes multiple types of tax abatements this report focuses on the two types of abatements designed to carry out the community redevelopment and rehabilitation goals of the Local Redevelopment and Housing Law NJSA. And other municipal charges through an on-. Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street.

Jersey City NJ 07302 Tel. Your canceled check is your receipt if you pay by check. Urban Enterprise Zone Property Tax Abatement.

Online Inquiry Payment. This charge can be added to the basis of your property. City of Jersey City PO.

City of Jersey City. My previous post in this series looked at the most recently available abatement data from the 2021 user friendly budget. We do not make copies of checks.

New Jersey Property Tax Benefits. Plus buyers must take full advantage of the exclusive offer for a full tax abatement until 2040. If you choose to pay your taxes at City Hall please bring your whole entire bill with you.

Jersey City Home values. 294 Griffith St 2 Jersey City NJ 07307. To request abatement you must submit the following.

In Person - The Tax Collectors office is open 830 am. The 5-year tax abatement program slowly rolls in taxes from no tax payments in the first year 20 in the second year 40 in the third year 60 for the fourth and 80 for the fifth year. TO VIEW PROPERTY TAX ASSESSMENTS.

Jersey City Mayor Steven Fulop has announced that the city will move forward with the termination of a tax abatement for four of the six buildings within The Beacon Community at 20 Beacon Way. You should send your request for abatement to the address listed on your billing notice. Buy and sell with Zillow 360.

This is the value pegged to the real estate as of the 2018 citywide revaluation.

A New Study Revives The Debate Over Property Tax Abatements

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

Map See Where Jersey City Hands Out Tax Abatements Nj Com

Tax Abated Apartment Building Complex Was Being Operated As Hotel Jersey City Officials Say Nj Com

New Jersey S Tax Exemption And Abatement Laws Onhike

A Look At Jersey City S Latest Tax Abatement Policy

Jersey City To Terminate Tax Abatement With The Beacon Hudson Reporter

A New Study Revives The Debate Over Property Tax Abatements

Why Taxes Are Rising In Jersey City Civic Parent

Map See Where Jersey City Hands Out Tax Abatements Nj Com

Jersey City S New Tax Is An Unconstitutional House Of Cards Lawsuit Says Nj Com

Abatements Put On Pause Hudson Reporter

Mapping Jersey City S Abatements By Project Type And Ward Civic Parent

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Jersey City Abatement Policy Civic Parent

Audit Report Jersey City Boe Lost Out On Millions Due To Inaccurate Pilot Billings Hudson County View

New Jersey Education Aid Why Jersey City S New Unpiloted Skyscraper Will Help Taxpayers Not Necessarily The Public Schools